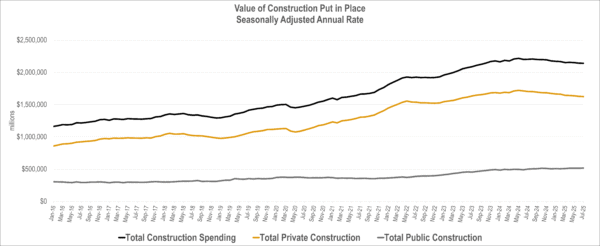

Recently, the US Census released the results of its monthly Value of Construction Put in Place Survey. The survey provides estimates of the total dollar value of construction work done in the U.S. This data includes design and construction spending for public and private projects.

The seasonally adjusted annual rate of $2.14 trillion for July 2025 represents a monthly decline of -0.1%. This year has seen a slow decline in spending as July was the 6th consecutive month with year-over-year declines at -2.8%.

Most of the decline is driven by decreases in private construction, notably the residential and commercial sectors. Total Private construction is down -4.6% year over year at $1.62 trillion while Public construction is up 3.4% at $515 billion.

Source: US Census Value of Construction Put in Place Survey September 2, 2025 release

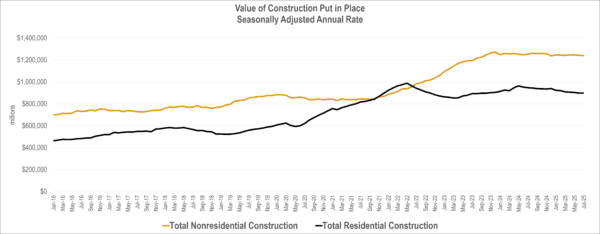

This decrease in growth highlights the continued uncertainty for the current economic climate. After contraction in real GDP growth in the 1st quarter of 2025 at -0.5%, the 2nd quarter GDP was revised up to 3.3%.

Factors such as higher-for-longer interest rates, changes in fiscal policy, trade uncertainty and other economic conditions are impacting markets to varying degrees. The residential market improved slightly at 0.1% for month-over-month growth while the nonresidential market declined -0.2%.

Source: US Census Value of Construction Put in Place Survey September 2, 2025 release

With respect to year-to-date growth in individual markets, 2025 continues a shift away from sectors that previously lead growth. The Water sector continues to grow in both Supply and Sewage & Waste Disposal, while growth in Amusement & Recreation remains strong and Public safety is a top growth market, replacing Transportation.

With the most recent update, 6 out of 17 sectors have year-to-date declines in total spending. Commercial continues to see declines due to interest rate sensitivity and other secular trends affecting demand. The Residential sector is seeing declines after rebounding from Spring 2023 lows, while Manufacturing is now seeing declines after significant growth during 2022-2024.