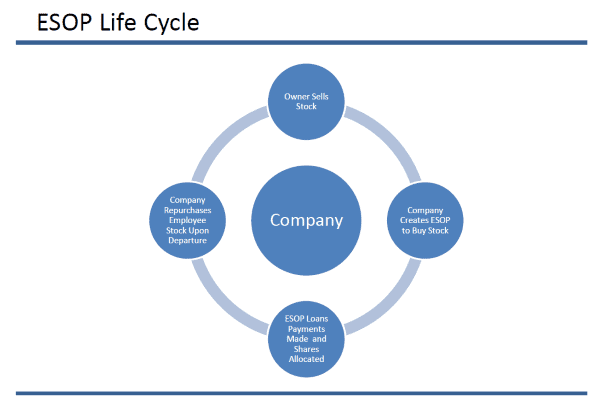

| Did you know there are at least 6 different ways shares of stock can be exchanged with an Employee Stock Ownership Plan? Some companies sponsor 100% ESOPs while others own a minority While the use of Employee Stock Ownership Plans by engineering firms is Join Bob Massengill of Pilot Hill Advisors to learn at least 6 different ways shares can be exchanged This program will be most informative for those exploring, new or A quick summary of ESOP Basics |