ACEC News / Market Forecast

July 23, 2019

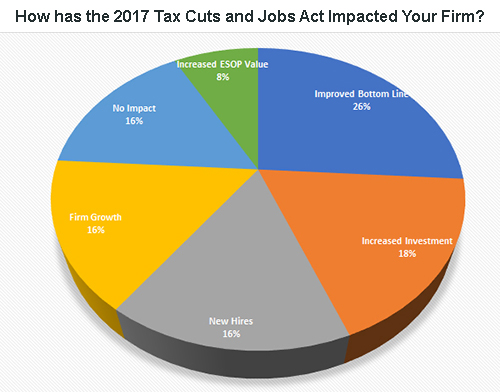

EBI Survey Respondents Report Positive Impacts of 2017 Tax Reform

In the latest Engineering Business Index survey released last week, more than one quarter of firm leaders (26 percent) credited the 2017 Tax Cuts and Jobs Act with improving their bottom line.”

The tax law lowered the corporate tax rate from 35 percent to 21 percent and—due to ACEC lobbying—created a new 20 percent deduction for pass-through entities such as S-corporations, partnerships, and sole proprietorships.

“Absolutely the right thing for business growth,” said one respondent. “Makes hiring harder and wages are going up, but profits are higher.”

The second highest response (18 percent) was the law allowed firms to increase investment. “The lower tax corporate tax rate incentivized us to retain more earnings and it improved our balance sheet,” said a firm leader.

Respondents also reported that the law has allowed them to make new hires (16 percent), grow their firm (16 percent), and increase the value of their Employee Stock Ownership Program (8 percent). Sixteen percent said the law had no impact.

Most firm leaders were positive about the tax cuts, but nearly one in five were critical, concerned about the ballooning federal deficit. “Looks good in the short term but ultimately a terrible idea,” said one respondent.

To read the latest EBI report, click here.

All comments to blog posts will be moderated by ACEC staff.